Ebb Tide

Revisiting Too-Big-to-Fail in the Wake of Recent Bank Failures

June 5, 2023

Rob Hajduch, Managing Director, Taxable Credit Research

The Federal Deposit Insurance Corporation’s (FDIC) announcement on May 1 that it had seized First Republic Bank and sold it to JPMorgan Chase renewed the debate over too-big-to-fail banks, notably the focus during the 2008 Great Financial Crisis (GFC). Growth in the size of bank balance sheets is not a recent phenomenon, however, with a trend in consolidation beginning in the mid-1980’s, driven primarily by evolving economic and industry dynamics.

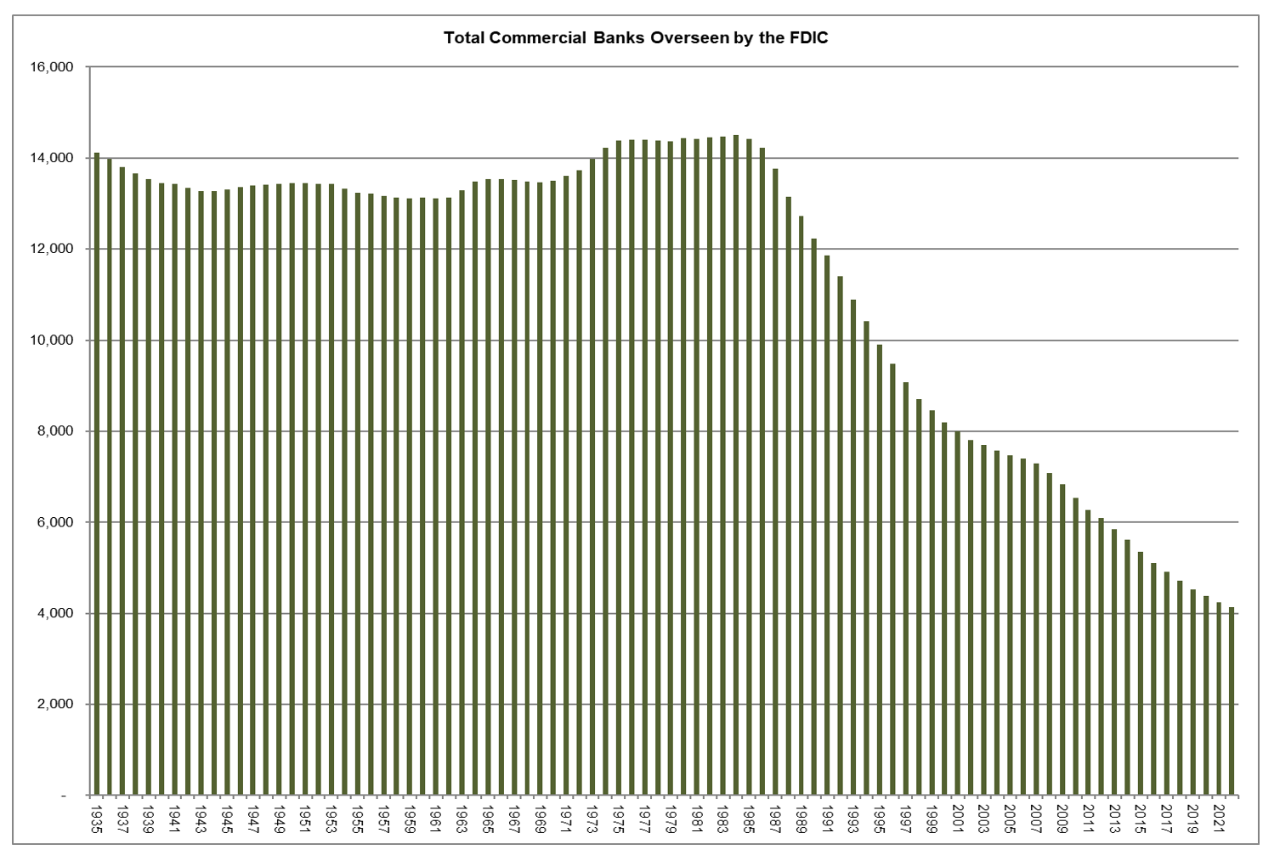

The following chart illustrates the number of commercial banks overseen by the FDIC since its first year of operation in 1934.

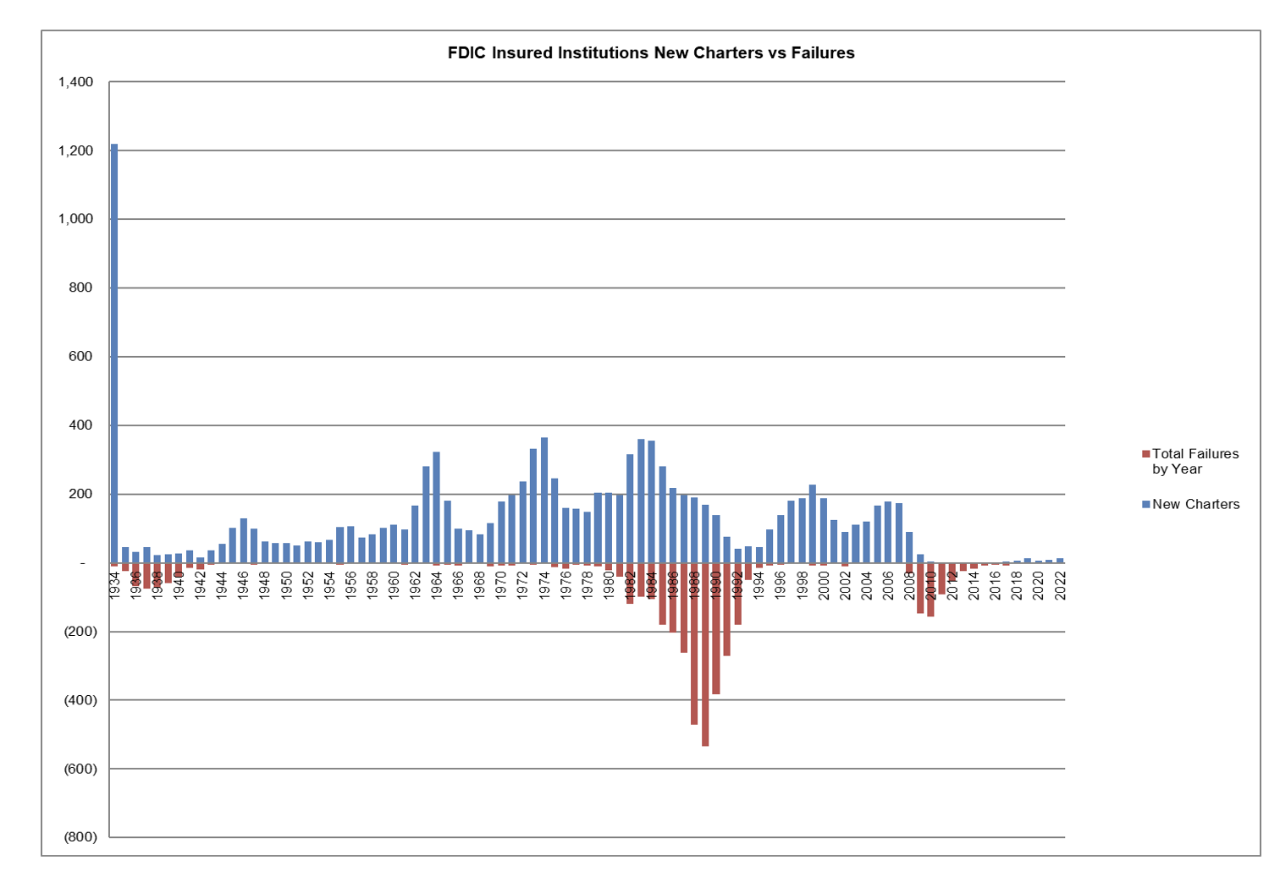

The number of banks in the system peaked in 1984 at 14,507, with the number of institutions reduced by 50% to 7,288 at the end of 2007. Subsequently, an additional 44% of system banks had been culled with only 4,135 remaining at the end of 2022. While part of the attrition can be attributed to two episodes of widespread failures (1984-1992 and 2008-2010), failures in the two disruptive periods only account for 30% of the total reduction of chartered banks.

Given that consolidation has been progressing for four decades and failures have been more an exacerbating factor than a driver, the impetus for combining appears to be aimed at gaining operating leverage and franchise extension to maintain returns. In 1992 (the first year following the late 1980’s/early 1990’s recession), the system reported a return on equity of 13.58% versus 11.83% in 2022. By contrast, the system’s ratio of operating expenses to total net revenue (overhead ratio) was nearly 64% in 1992, but had improved to 58% in 2022 as the average size of a bank had increased from roughly $330 million to more than $5 billion. As individual banks have gotten bigger, economies of scale have driven improved efficiency and allowed the system to maintain operating returns above the cost of capital.

On a secondary level, a lack of new charters awarded by the FDIC since the GFC has contributed to the pace of consolidation, with a total of 62 new banks formed since 2009. The rate of new bank formation has improved since 2019, although the peak number of new charters awarded was 14 in 2022, so even a substantial increase in new bank formation is unlikely to have a significant impact.

The trend toward a system with fewer, larger banks appears to be inexorable, particularly in the current environment of sharply higher interest rates, the rising costs of technology investment, and the dearth in new bank formation. Consequently, the prospects for arresting the secular evolution of the system, regardless of rhetoric, seem as unlikely to succeed as reversing the outgoing tide.

Sources

FDIC

USBAM Research