CMO Primer

The Ins and Outs of Collateralized Mortgage Obligations

September 10, 2024

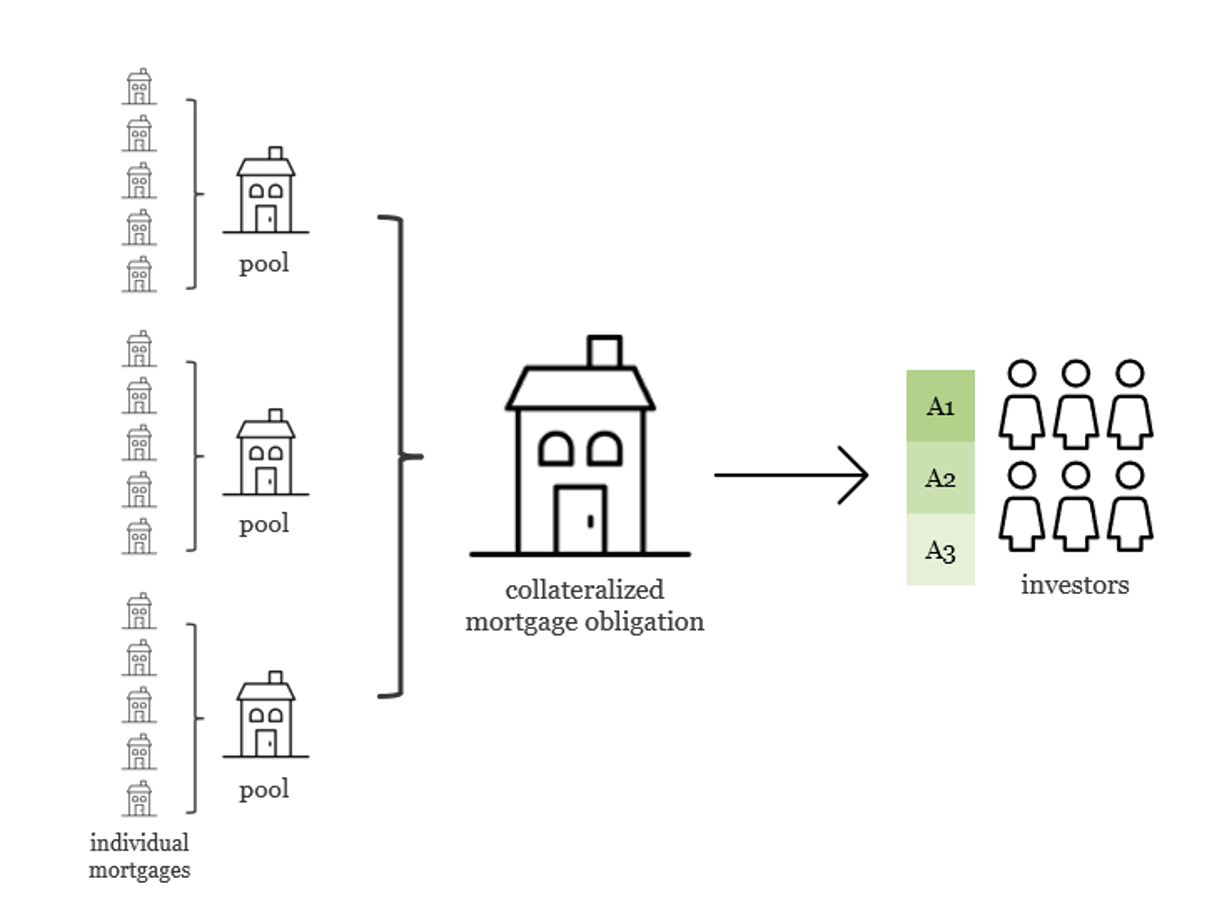

In our initial introduction to mortgage-backed securities (MBS), we discussed agency pass-throughs. These types of securities pool mortgages and “pass through” the principal and interest payments to investors. Below, we will delve into a more complex type of mortgage-backed security called a collateralized mortgage obligation (CMO).

Collateralized Mortgage Obligations

The first CMO was created in 1983 by investment banks Salomon Brothers and First Boston on behalf of Freddie Mac. The purpose was to offer an instrument that provided different payment streams and risk profiles which catered to a wider investor base than traditional MBS pass-throughs.

Agency CMOs are issued by the Government National Mortgage Association (Ginnie Mae), the Federal National Mortgage Association (Fannie Mae), and the Federal Home Loan Mortgage Corporation (Freddie Mac). The issuing agency also guarantees certain tranches. As described in our MBS primer, all three agencies have a mandate to promote liquidity, stability and affordability to the U.S. housing market.

While CMOs have lower-rated, subordinated, and/or unguaranteed tranches, USBAM only purchases AAA-rated, senior, fully guaranteed MBS and CMOs.

CMOs vs. MBS Pass-throughs

A collateralized mortgage obligation is created by pooling together a collection of securities backed by individual mortgages. Unlike a pass-through, the cashflows received from these mortgage pools are allocated to different classes (or “tranches”) of the CMO based on a predetermined set of criteria. This payment hierarchy allows CMOs to be structured to meet a variety of investors’ demands, including creating more predictable cash flows and payment windows.

To expand, a CMO could be structured with one or more senior tranches that have reduced cashflow variability as well as accompanying higher-yielding tranches that are subject to greater cashflow volatility. In this way, CMOs provide an opportunity for investors to select tranches that best align with their maturity needs, risk tolerances and preferences.

Sample CMO Structure – “Sequential Pay”

CMO Types

While there are a wide variety of CMO structures, two common types are:

1) Sequential pay; and

2) Planned amortization class (PAC)/support.

Sequential CMOs

As the name suggests, a sequential pay CMO contains tranches that receive principal payments in sequential order. Typically, the first tranche receives all principal payments until it is completely paid off in full. Once the first tranche is paid off or retired, the second tranche begins to receive all the principal payments until it too is entirely paid off. This process continues until the principal balances of all the tranches are completely paid.

If the mortgages pay interest and principal, investors receive monthly interest payments based on their tranche’s outstanding principal balance and stated coupon rate. Once a tranche is paid in full, investors in that tranche no longer receive interest payments.

This structure may provide greater, though not complete, certainty as to the timing of future cashflows. Generally, investors seeking shorter-term maturities purchase earlier tranches, and investors seeking long-term maturities purchase later tranches. But, both shorter and longer tranches may be subject to significant cash flow variability if interest rates move a lot.

Planned Amortization Class (PAC)/Support CMOs

PACs were created to provide investors with an even higher degree of cashflow certainty than sequential pay CMOs. The first tranche in a PAC is designed to receive principal repayments at an assumed (but not guaranteed) prepayment speed. The assumed prepayment speed results in a well-defined cash flow stream consisting of principal and interest. The cash flows of the first tranche are supported by other tranches in the PAC that absorb prepayments outside of a specified band. In other words, if prepayments come in higher than expected, the repayment of principal in the first tranche is unchanged as the additional principal repayments are absorbed by the support tranche.

This predictability makes PAC tranches attractive to investors who are seeking stable income streams or would like to minimize prepayment risk. PACs that are structured to have more coverage from support tranches typically have less prepayment volatility because the additional support tranches can absorb more of the cashflow variability. In general, PAC tranches typically have a lower return potential than support tranches because they will experience less cashflow uncertainty.

There are some risks to this structure. For example, if prepayments remain higher than the assumed prepayment speed (the PAC “band” or “level”), then eventually the support tranches could be completely paid off as the extra principal payments are used to pay down the support tranches. At this point, the PAC bonds are referred to as “busted” because the cashflow support mechanism is no longer in place.

These so-called busted PACs essentially behave like sequential CMOs because the support tranches that otherwise would absorb the variability of principal payments are no longer outstanding, causing the PAC bonds to lose their predictability.

CMO Investment Considerations

In summary, a CMO is a complex financial instrument that can play a role in a diversified investment portfolio. By pooling together various mortgage-backed securities and slicing them into tranches with varying risk and return profiles, CMOs offer investors targeted exposure to the mortgage market.

Overall, agency CMOs provide a federal agency guaranteed alternative to Treasuries. Compared to pass-throughs, CMO structures may provide greater cashflow certainty, particularly for the shorter-maturity tranches.

CMOs can provide a variety of benefits to a client’s investment portfolio, including potentially providing diversification and returns in excess of other governmental securities. As with any investment, thorough due diligence and alignment with overall investment strategy are key to leveraging this type of security effectively within a portfolio.