Trouble Looming in Commercial Real Estate?

Examining Life Insurers' Commercial Mortgage Loan Portfolios

August 16, 2023

Kevin Xie, CFA, Credit Analyst

In the aftermath of the series of bank failures in the first half of 2023, market attention has focused on the commercial real estate (CRE) sector as a likely emerging pressure point on the financial system. CRE’s inherent cyclicality reflects macroeconomic forces and interest rate sensitivity. The regional banking turmoil and a looming maturity wall of $1.5 trillion in debt, scheduled for repayment by the end of 2025, may exacerbate funding pressure on the sector. Regional banks play a critical role in commercial mortgage lending. According to Mortgage Bankers Association data, banks with assets less than or equal to $250 billion held 30% of commercial/multi-family mortgages at the end of 2022. Within the CRE sector, Pressure is particularly acute for office landlords, as hybrid working arrangements implemented during COVID lockdowns have emerged as a secular trend.

Life insurance companies are also significant lenders to the CRE sector. Commercial mortgage loans (CMLs) align well with longer-tail liabilities and provide diversification for investment portfolios. At the end of 2022, life insurers held a 15% share in the commercial/multi-family mortgage market, placing them just behind banks, federal agencies and GSEs (21%). Life insurers also have CRE exposures through investments in CMBS, REITs, real estate alternative investments, and direct real estate holdings.

U.S. insurance operating companies are required to prepare detailed annual statutory filings with their state regulators, providing a wealth of financial data, including detailed investment holdings. Disclosures reveal that CMLs account for two-thirds of aggregate CRE exposure and are equivalent to 12% of total invested assets.

In analyzing this data, we note that life insurers’ CML portfolios reflect two key characteristics highlighting conservative underwriting:

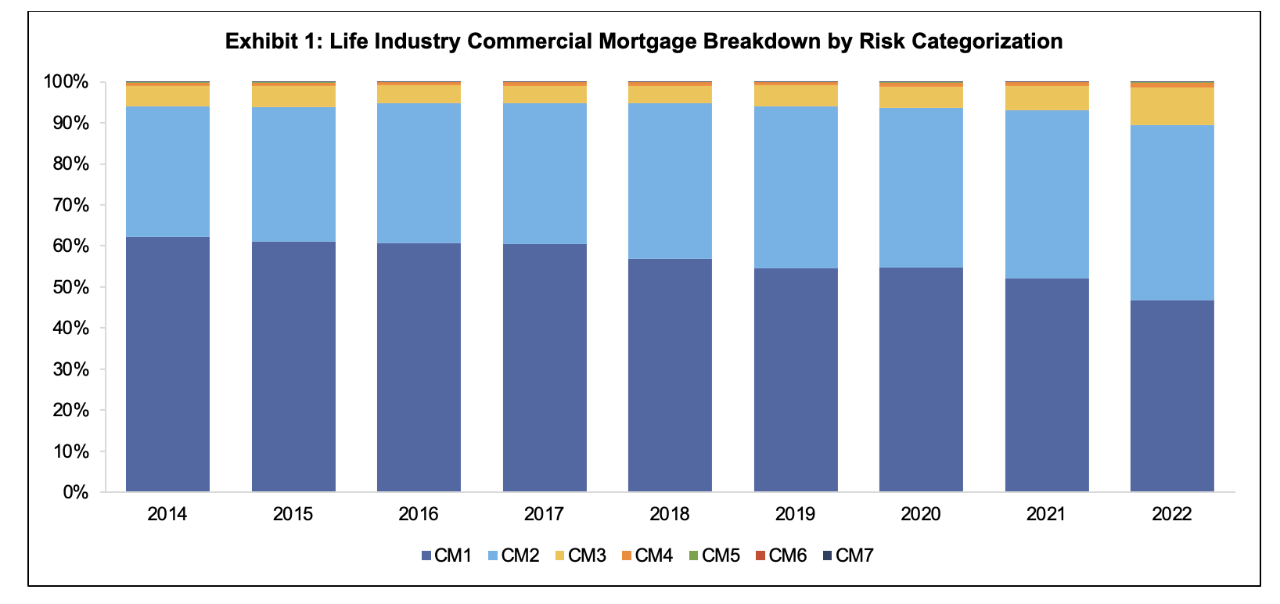

- Life insurers’ CML portfolios are high quality. In statutory filings, each CML is assigned a risk rating category from C1 to C7, determined by the loan’s loan-to-value ratio (LTV) and debt service coverage ratio (DSCR). By risk rating category, we observe that approximately 90% of life insurers’ commercial mortgage loans fall within CM1 and CM2 categories, which are the two highest mortgage rating categories and have relatively low LTV and high DSCR. CMLs falling within the CM1 category have DSCRs greater than or equal to 1.5x and LTVs less than 85%. CMLs fall within CM2 category require DSCRs greater than or equal to 0.95x and LTVs less than 100%. Additionally, CMLs with lower DSCR must have lower LTVs to be classified as CM2, and vice versa. For example, a CML with DSCR of 1.0x and LTV of 70% is classified as CM2. However, a CML with the same DSCR of 1.0x and a higher LTV of 80% would be classified as CM3.

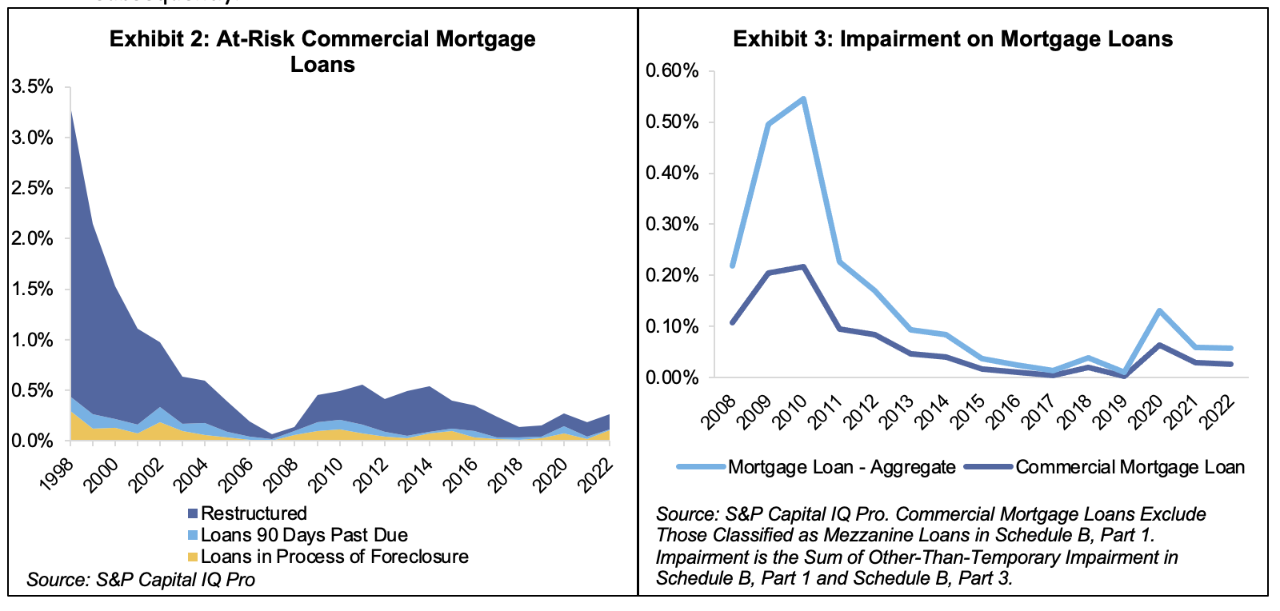

- Low level of at-risk CML (restructured, 90+ days past due, in process of foreclosure) and impairment through-cycle historically. Since the CRE downturn in the 1990s, exposure to at-risk loans has been limited. Even during the 2008 global financial crisis and its aftermath, shares of at-risk CMLs peaked at 56 basis points (bps) in 2011 and has been below 50 bps since 2015. At-risk loans have mostly been restructured loans, reflecting life insurers willingness to collaborate with troubled borrowers to avoid onerous capital requirement charges, ranging from 11% to 13% related to CM6 (90+ days past due) and CM7 (in the process of foreclosure) versus the charges of 7.5% or lower for loans classified from CM5 and above. The percentage of commercial mortgage loans 90+ days delinquent or in the process of foreclosure has consistently been below 0.20% of total exposure since 2003. The introduction of other-than-temporary impairment (OTTI) in the late 2000s provided additional disclosure on credit-driven impairments, with OTTI on CMLs peaking at 0.22% bps in 2010 before receding to 0.10% subsequently.

Zooming in to CMLs backed by office properties, office CMLs account for 22% of the entire portfolio, with concentrations in California (22%) and New York (14%). Although DSCR is not available for each CML, LTV can be estimated using data provided in the filings. Office CMLs generally exhibit low levels of LTVs, with the weighted average LTV at 55%. The distribution is also favorable. 94% of office CMLs carry LTVs of less than or equal to 75%, and 69% of office CMLs carry more stringent LTVs of less than or equal to 60%. Hypothetically, those metrics translates to 1) 94% of office CMLs would likely be insulated from a ~25% drop in office property value; 2) 69% of office CML would likely be insulated from a draconian drop ~40% in property value, which was an assumption adopted in the severely adverse scenario of the Federal Reserve’s annual bank stress test. Consequently, the ultimate write-off rates for the entire office CML portfolio will be alleviated by the LTV buffer embedded in the portfolio.

Nevertheless, we acknowledge a decline in credit quality of the CRE portfolio, as migration of commercial mortgage loans to higher-risk buckets is visible in Exhibit 1. Further deterioration is expected as elevated interest rates negatively impact both LTVs and DSCRs through declining collateral valuation, reduced operating income, and rising funding costs.

Ultimately, after examining life insurers’ CML portfolio, we expect the financial impact on life insurers’ financial performance to be incremental given the CML portfolio’s high quality. We also anticipate that losses will be further mitigated by proactive restructuring of loans to troubled borrowers as they near maturity. Life insurers’ CML maturities are laddered conservatively, with 7% due in 2023, 8% maturing in 2024, and 10% due in 2025.

Sources

Barclays

Bloomberg

FDIC

Federal Reserve

J.P. Morgan

Moody’s Investor Service

Morgan Stanley

Mortgage Bankers Association (MBA)

National Association of Insurance Commissioners (NAIC)

Real Capital Analytics

S&P Capital IQ Pro

USBAM Research